Legality

Paybuyer will, initially, have a No Purchase option.

Paybuyer gives users novel chance payments, also called probabilistic payments. Each payment is a chance to win a prize, and each payment has an explicit expected value, which is currently set at $.50 or $1.

These chance payments are similar to, but very different from, conventional sweepstakes entries and lottery tickets. As explained below, they're different in such a way that Paybuyer is not required to offer a No Purchase entry option.

However, attorneys have advised us that our system is so new that if this conventional entry option is missing, shakedown lawsuits could result. To obviate such suits, Paybuyer will initially offer No Purchase Necessary entries.

Expected Value (EV) payments in Paybuyer aren't gambling instruments.

In U.S. law, gambling has three elements: prize, chance, and consideration. If an offer, game or payment vehicle is missing one of these elements, it's not a gambling instrument.

EV payments in Paybuyer certainly have chance and a prize, but they're missing consideration.

What is consideration? Consideration is what a person pays or gives in exchange for the chance to win a prize.

Example: If you pay $1 to a convenience store for a lottery ticket, that $1 is consideration, and that ticket is a gambling instrument.

In the U.S., it's illegal for a company to give you a sweepstakes entry or lottery ticket on the condition that you buy that company's product. That's because part of your purchase payment could be thought of as payment for the entry or ticket.

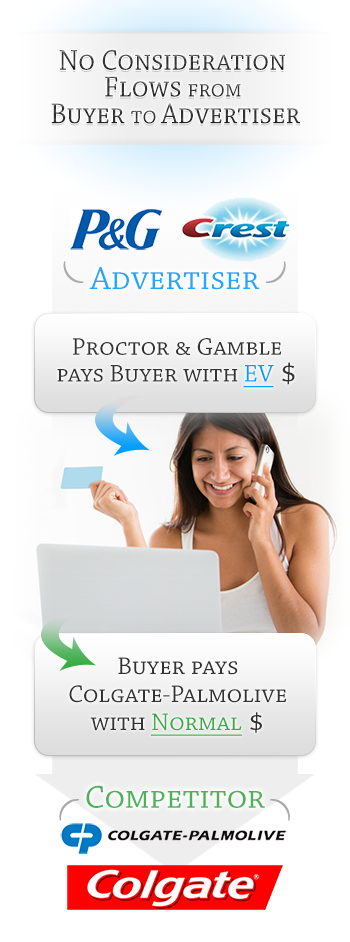

Example: It's illegal for Proctor & Gamble to offer you a sweepstakes entry on the condition that you buy a tube of their toothpaste, Crest.

Therefore, when companies offer sweepstakes entries when you buy their products, they also offer a No Purchase entry option. They cannot require you to buy their product.

By contrast, in a Paybuyer-type system, while you must buy a product to receive a valid EV payment (a chance to win a prize), your purchase is not consideration. Here's why: if you receive an EV payment from an advertiser, that payment is valid if you buy from the advertiser's competitor.

Example: Proctor & Gamble can give you an EV payment that's valid if you buy their competitor's toothpaste, Colgate.

What if an advertiser gives you an EV payment for attention and you then buy from the advertiser? We'll you weren't required to buy from that advertiser so you weren't forced to pay consideration. In case this point is controversial for AG's, these EV payments can be voided, while keeping the core pay-for-attention method intact.

It's true that to receive an EV payment you must click to a website or spend a bit of time on a call with the advertiser. But sweepstakes laws don't regard these bits of time as consideration:

"Today, consideration for gambling almost always means betting money. This is particularly true when it comes to Internet gambling. Even if players have to spend time at a web page and effort in filling out a form or playing a game, and the web site operator gets more eyeballs looking at its banner ads, there is no consideration." I. Nelson Rose in Gambling and the Law, 2001

In short, EV payments in Paybuyer aren't gambling instruments because recipients don't pay for them. Legally speaking, they're gifts.